PUBLIC AND EMPLOYERS LIABILITY INSURANCE

What is Public and Employers Liability Insurance?

Public Liability Insurance is designed to protect and cover businesses from the risk of claims made by a third party, such as member of the public or another business, for example if you damage a property while working. Holding valid Public Liability Insurance is often a requirement of working or subcontracting to another company. The limits are between £1 million and £5 million and the premiums are based on turnover and number of employees.

If your business employs any staff, including part-time staff, trainees or sub-contractors, you are required to have Employer's Liability Insurance by law, covering claims made against you by an employee. Employers Liability Insurance is usually set at £10 million as standard. This will cover you if one of your employees is injured at work, or they, or a former employee becomes ill as a result of their work while in your employment.

Why do you need liability and employer's insurance?

- Protects your business financially in the case of a claim

- Ensures you comply with the law

- Enhanced security and safety for your customers

- Can satisfy employers, opening your business up to more opportunities

Ensuring your business is covered, whatever your trade

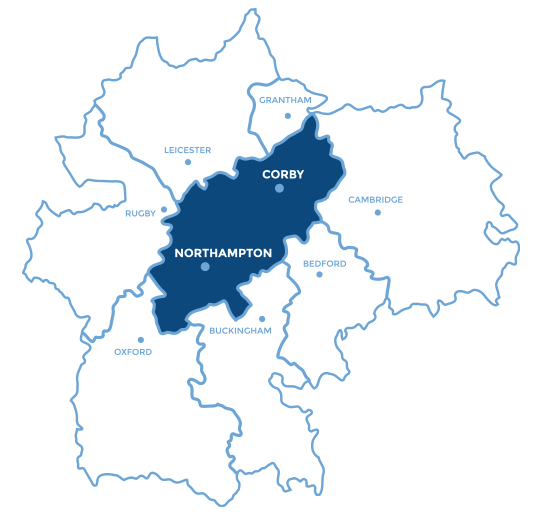

With over 20 years’ experience in the industry, at Excel Insurance, we can find a policy that’s right for you. We arrange Insurance Policies for a wide range of trades both locally in Northamptonshire and further afield across the UK, so please contact us to discuss your requirements. With exclusive access to a range of trusted insurers, we can select the scheme which is most suitable to your business, and often at a premium you won't find yourself.

-

LANDLORDS' PROPERTY INSURANCE

LANDLORDS PROPERTY -

SHOP & RETAILERS INSURANCE

SHOP & RETAILERS INSURANCE -

OFFICE INSURANCE

MOTOR FLEET INSURANCE -

MOTOR FLEET INSURANCE

MOTOR FLEET -

PERSONAL INSURANCE

PERSONAL

INSURANCE

PROTECT YOUR BUSINESS WITH public & EMPLOYERS liability INSURANCE

cALL: 01604 250 625

Registered Company Name: FINANCE INVESTMENTS LIMITED

Registered Address: Suite 19F Mobbs Miller House, Ardington Road, Northampton, NN1 5LP

RRRRrrRegistered Company Number: 3043444

Excel Insurance and Excel Insurance Services are trading names of Finance Investments Limited who are Authorised and Regulated by the Financial Conduct Authority.

Firm Reference No. 306629.